|

I. Business Overview

WFOE PFM, or Whole Foreign Owned Enterprise Private Fund Management, is the main entity of foreign-funded asset management institutions established in China to carry out management business for private securities investment funds. In accordance with the policies developed in the seventh and eighth rounds of the China-US Strategic and Economic Dialogue and the seventh China-UK Economic and Financial Dialogue, and with the consent of the CSRC, whole foreign owned enterprise and joint-venture private fund management (WFOE PFM) are allowed to carry out the business of private securities fund management in China since June 2016.

II. Target Customers

According to existing private fund regulations, the WFOE PFM custody services of ICBC mainly target at: Foreign sovereign funds, pension funds, endowment funds, charitable funds, fund of investment fund (FOF), insurance companies, banks, securities companies and other approved foreign institutional investors that establish companies to carry out management business for private securities investment fund in China.

III. Scope of Services

1.Account opening: Open fund account, securities account and other related account for WFOE PFM products as required by regulatory authorities;

2.Asset custody: Set separate accounts for different WFOE PFM products under custody, guarantee the consistency between amount, accounts and vouchers, and ensure the integrity and independence of fund assets;

3.Capital clearing: Complete capital clearing and delivery of fund assets in a timely manner, according to the manager’s investment instruction;

4.Investment supervision: Supervise the compliance of the fund manager’s instructions and investment operations in accordance with laws and regulations and the requirements of the trustor;

5.Accounting: Conduct accounting for funds, and review and check the net value of fund assets calculated by fund managers;

6.Custody reports: Submit the reports on fund custody service and financial reports to fund investors and regulatory authorities on a regular basis;

7.Record keeping: Keep custody records, account books, reports and other related materials in connection with WFOE PFM custody business for at least 15 years.

IV. Service Advantages

As the largest custodian bank in China, ICBC has maintained its first position in the market for 25 consecutive years in terms of market share of asset custody business.

ICBC is the most professional custodian bank in China, with an advanced custody service system independently developed by it, which can meet the customized needs of WFOE PFM in system connection.

ICBC, the most powerful domestic commercial bank, owns a fast clearing network, abundant RMB funds and strong A share settlement capability, hence it can provide WFOE PFM customers with efficient and comprehensive service support.

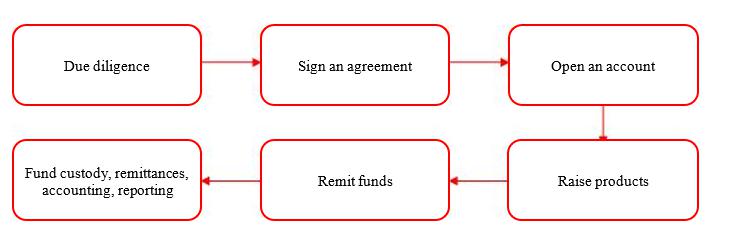

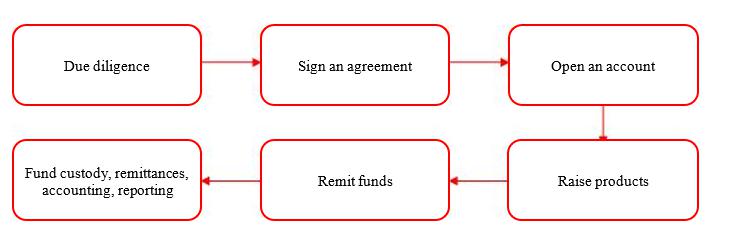

V. Business Flow

VI. Contact Information

If you would like to apply for any service, please contact the Global Asset Custody Division of Asset Custody Department of ICBC:

Contact: Ma Pingchuan

Tel.: (8610) 81012306

E-MAIL: pingchuan.ma@icbc.com.cn

|