|

I. Business Overview

QFLP system (Qualified Foreign Limited Partner system) is another important move adopted by the Chinese government, following the introduction of QFII system, to liberalize primary market for foreign institutional investors, indicating that China is gradually releasing the strict restrictions on the entry of foreign capital to China, hence it can be regarded as another pilot breakthrough in terms of existing foreign exchange control system in China. QFLP system was first implemented on a trial basis in the cities including Beijing, Shanghai and Chongqing. The competent department accepting application would approve certain quota for foreign-invested equity investment institutions, as the case may be. On January 12, 2011, the Implementation Measures for Carrying out the Pilot on Foreign-invested Equity Investment Enterprises in Shanghai was released, marking the formal commencement of QFLP system pilot in Shanghai. The Measures specifies that qualified foreign limited partners should entrust a domestic commercial bank as their custodians to manage their assets. As at the first half of 2022, more than 20 cities across the country have already launched pilots.

II. Target Customers

According to existing QFLP regulations, the QFLP custody services of ICBC mainly target at: Foreign sovereign funds, pension funds, endowment funds, charitable funds, fund of investment fund (FOF), insurance companies, banks, securities companies and other approved foreign institutional investors.

III. Scope of Services

1.Account opening: Open fund account, securities account and other related account for QFLP customers as required by regulatory authorities;

2.Asset custody: Set separate accounts for different QFLP investments under custody, guarantee the consistency between amount, accounts and vouchers, and ensure the integrity and independence of fund assets;

3.Capital clearing: Complete capital clearing and delivery of fund assets in a timely manner, according to the manager’s investment instruction;

4.Investment supervision: Supervise the compliance of the fund manager’s instructions in accordance with laws and regulations and the requirements of the trustor;

5.Custody reports: Submit the reports on fund custody service and financial reports to fund investors and regulatory authorities on a regular basis;

6.Record keeping: Keep QFLP custody records, account books, reports and other related materials for at least 15 years according to national regulations.

IV. Service Advantages

As the largest custodian bank in China, ICBC has maintained its first position in the market for 25 consecutive years in terms of market share of asset custody business.

ICBC is the most professional custodian bank in China, with an advanced custody service system independently developed by it. The system has obtained ISAE3402 authentication (formerly known as SAS70), the first one of its kind in China, indicating that ICBC’s custody services have met international standards.

ICBC, the most powerful domestic commercial bank, owns a fast clearing network, abundant RMB funds and strong A share settlement capability, hence it can provide QFLP customers with efficient and comprehensive service support.

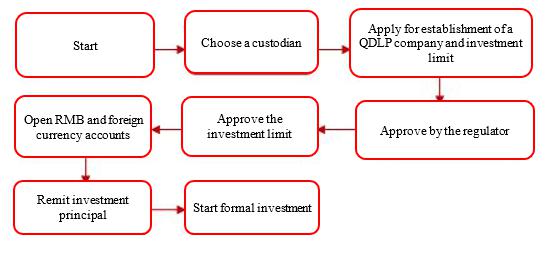

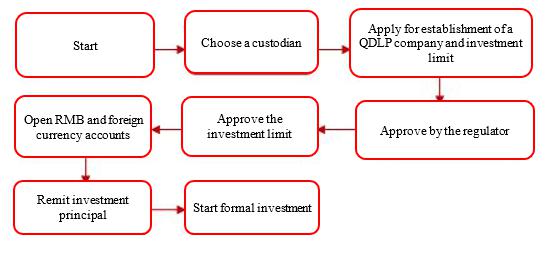

V. Business Flow

VI. Contact Information

If you would like to apply for any service, please contact the Global Asset Custody Division of Asset Custody Department of ICBC:

Contact: Lei Siqi

Tel.: (8610) 66104709

E-MAIL: siqi.lei@icbc.com.cn

|