|

I. ICBC Wealth Management Products

i. Description

The ICBC corporate wealth management products are wealth management products designed for corporate customers to manage liquidity flexibly, reduce financing cost, hedge risk in order to add value to the assets. Investment manager is the bank.

ii. Target customers

Enterprises, public institutions and organizations which are in line with the regulatory requirements and need to manage wealth are welcomed to buy ICBC wealth management products.

iii. Major product lines and features

The ICBC Wealth Management - Win-win No.1: T+0 product, tantamount to current deposit (code: 0701CDQB). Buy/redeem anytime, amount credited into account in real-time, sound liquidity, good earning, best product for enterprises to manage liquidity.

The ICBC Wealth Management - Win-win No.2: Dividend every week, Sun-Moon, 14-day, 21-day, 28-day, 60-day, 150-day, 180-day, 240-day and 360-day enhanced income series and 42-day, 63-day, 98-day and 126-day principal-guaranteed and non-principal-guaranteed wealth management products, no subscription period, convenient subscription and redemption, sound liquidity, good earning, high security, saving time and effort.

The ICBC Wealth Management - Win-win No.3: A fixed-income principal-guaranteed and non-principal-guaranteed wealth management product, low risk, stable income; offered in fixed periods, easy to invest.

The ICBC Wealth Management - Win-win No.5: Net worth product, structured product (linked to CSI300 Index, gold price, real estate index and CPI) and foreign currency product. Stable investment, strong growth; accumulate wealth all over the world.

Product under the New Regulation: All products under the New Regulation are net-worth products, including “Tianlibao”, “Xindeli”, “Xinwenli” and “Quanqiu Tianyi”.

“Tianlibao” is a real-time trading quasi-monetary fund product. It can be redeemed at any time during the trading hours in working days with funds credited to the account immediately. Its funds are mainly invested in investment products with high security and good liquidity, such as bonds and deposits. It is a wealth management product that combines security, liquidity and profitability.

“Xindeli” has a flexible term set as per customer’s needs but not less than 90 days. It is a fixed-income product with high security. The interest accrues from the T+1 day and the redemption fund is credited on the T+3 day.

“Xinwenli” is a fixed-term open product and has two terms, one month and three months. It belongs to fixed-income products. With funds invested mainly in bonds, it has high security. The interest accrues from the T+1 day and the redemption fund is credited on the T+3 day.

“Quanqiu Tianyi” is a foreign currency wealth management product with a minimum term of 90 days. The product is of fixed-income type. With funds invested mainly in overseas large-amount certificate of deposit and overseas preference stocks, it has high security and can meet investors’ needs for raising capital in USD and paying interest in USD to avoid exchange rate risk.

iv. Requirements

The customer has opened a corporate settlement account at the ICBC or meets the ICBC's requirements.

v. Application process

1. ICBC counter – open a trading account, bind the account with bank account -> choose wealth management product, sign subscription agreement -> finish buying over the counter;

2. Internet Banking – sign up Internet Banking service -> open a trading account, sign service agreement -> choose wealth management product, read the prospectus and buy.

vi. Service channels and hours

The ICBC corporate wealth management products can be bought/sold at the ICBC counter or through e-banking.

Please refer to the prospectus for the trading hours of wealth management products.

vii. Operational guide

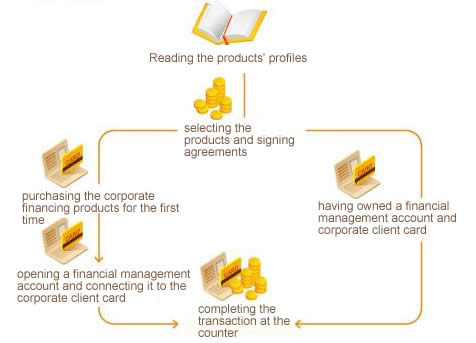

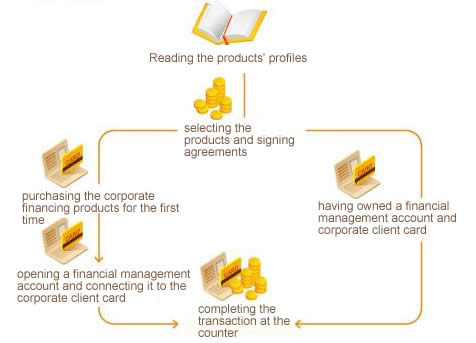

1. ICBC counter

The above procedures are for customers to buy wealth management products at the ICBC general outlets or corporate banking outlets. The ICBC teller will assist the customer to go through the procedures or buy on behalf, which is simple and easy.

2. Internet Banking

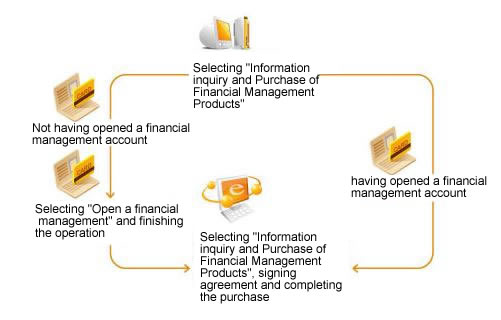

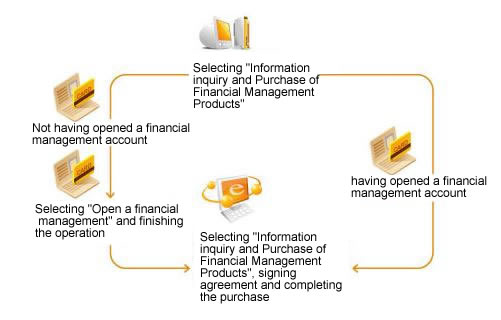

Login Corporate Internet Banking, go to "Wealth Management", click "ICBC wealth management products":

If the customer has already registered the ICBC Corporate Internet Banking, click the above and buy wealth management products in offer or available for buying/selling. The procedures are as follows:

viii. FAQs

Q1: I have never bought any corporate wealth management products from the ICBC, is it complicated if I buy now?

A1: If you have already opened a corporate settlement account at the ICBC, go to the ICBC corporate outlet, open a trading account and bind the account with your corporate customer card. Now you can start buying. The ICBC tellers will assist you in completing all the procedures.

If you are already a user of the ICBC Corporate Internet Banking, sign up wealth management services online and open the account.

Q2: Can the ICBC guarantee return on both the principal and proceeds if I buy corporate wealth management products from the ICBC?

A2: At present what is offered by the ICBC are products with non-guaranteed principal and floating proceeds. This has been expressly stated in the product prospectus. As of today the ICBC does not offer wealth management products that guarantee return on the principal and proceeds. Yet considering the performance of our products, all ICBC products generate enough return to cover both the principal and proceeds which will be paid to customers at the highest expected yield according to the agreement.

Q3: Is there any limit for buying the ICBC corporate wealth management products?

A3: As required by regulatory authority and risk level of the products, the initial subscription amount for each product is different, the minimum is RMB50,000. The ceiling amount is the total size of fund raised (for further information, please refer to product prospectus and agreement).

Q4: Can I draw the principal before the duration period expires?

A4: This depends on the agreement signed between you and the ICBC. To ensure maximum return for you, at present most of the ICBC corporate wealth management products cannot be terminated in advance.

ix. Risk Prompt

Financial planning carries investment risks; customers should be fully aware of the risks and invest cautiously. Here are the risks:

1. Market risk: ICBC corporate wealth management products are not principal guaranteed. As the financial market fluctuates, customers may face market risk when buying the products. You have to bear opportunity cost if the PBOC raises the deposit interest rate in the duration of the product.

2. Credit risk: Customers may face the default of the borrowers and bond issuers involved in the assets or asset portfolios that they invest in. The principal and proceeds of the investment may suffer loss if these occur.

3. Liquidity risk: Some wealth management products cannot be redeemed or terminated before the duration period expires. Customers may face the liquidity risk if in need of cash while holding the products as a result of unmatched periods or lose other investment opportunities.

4. Force majeure and accident risk: Natural disaster, financial crisis, war, changes in state policy and other unforeseen, inevitable and insurmountable force majeure circumstances may affect the inception of the product, investment operation, return of customers' investment, information disclosure and public announcement, to the extent that yield may be reduced and causes the loss of principal. The ICBC will not be responsible for any loss caused by the above force majeure and accidents. Customers should take the risks by themselves.

5. Policy risk: Changes in state policy and the applicable laws and regulations that may affect the issue, investment and redemption of the product to the extent that causes the loss of principal.

Please refer to the risk disclosure in the product prospectus for the risks involved in the product.

II. Underwriting Wealth Management Products

i. Description

Underwriting wealth management products are designed and offered by third-party asset management companies (fund companies, securities companies, trust companies and investment banks). The ICBC sells the products to corporate customers. The difference is that, investment manager is the third-party asset management company, not the ICBC.

ii. Target customers

Enterprises, institutions and organizations which are in line with the regulatory requirements and need to manage wealth are welcomed to buy, provided there is a full understanding on the products.

iii. Main products

The ICBC maintains long-term relationship with well-known fund companies and securities companies and jointly rolls out a range of services such as public funds, asset management plan for fund companies, asset management plan for the subsidiaries of fund companies and asset management plan for securities companies.

iv. Distinctive advantages

The products have fully demonstrated the design and investment skills of third-party asset management companies. Many unique services are available to serve the corporate customers.

v. Requirements

The customer has opened a corporate settlement account at the ICBC or meets ICBC's requirements.

vi. Application process

1. ICBC counter – open a trading account, bind the account with bank account -> choose wealth management product, sign subscription agreement -> finish buying.

The above procedures are for customers to buy wealth management products at the ICBC general outlets or corporate banking outlets. The ICBC teller will assist the customer to go through the procedures or buy on their behalf, which is simple and easy.

2. Internet Banking – sign up Internet Banking service -> open a trading account, sign service agreement -> choose wealth management product, read the prospectus and buy.

vii. Service channels and hours

Wealth management products underwritten by the ICBC can be bought/sold at the ICBC counter or through e-banking. Trading hours are 9:00-17:00 every working day. If there are special requirements, refer to the product prospectus.

viii. Risk Prompt

Financial planning carries investment risks; customers should be fully aware of the risks and invest cautiously. Here are the risks:

1. Market risk: As the financial market fluctuates, customers may face market risk when buying the products. You have to bear opportunity cost if the PBOC raises the deposit interest rate in the duration of the product.

2. Credit risk: Investment portfolio of wealth management products contain corporate bonds, trust financing items and other credit products. Customers may face the risks of delayed payment by bond issuers and credit default by borrowers. The principal and proceeds of the investment may suffer loss if the same occurs.

3. Liquidity risk: Some wealth management products cannot be redeemed or terminated before the duration period expires. Customers may face the liquidity risk if in need of cash while holding the products as a result of unmatched periods.

4. Force majeure and accident risk: Natural disaster, financial crisis, war, changes in state policy and other unforeseen, inevitable and insurmountable force majeure circumstances may affect the inception of the product, investment operation, return of customers' investment, information disclosure and public announcement, to the extent that yield may be reduced and causes the loss of principal.

Please refer to the risk disclosure in the product prospectus for the risks involved in the product.

ix. Notes:

Wealth management products underwritten by the ICBC are managed by third-party asset management companies. The ICBC only sells the products and does not bear any responsibility for the product design and investment management. Before buying, customers are advised to read carefully the terms and conditions between wealth management products sold by the ICBC and the ICBC wealth management products.

Note: Information herein is for reference only. Refer to the announcements and regulations of local branches for further details.

|